“Financial Habits for Beginners: Mastering Budgeting and Saving”

“Financial Habits for Beginners: Mastering Budgeting and Saving: Budgeting and saving are two crucial financial habits that can help individuals manage their money and reach their financial goals.

Budgeting involves creating a plan for your income and expenses, so you can make sure you have enough money to cover all of your bills and still have some left over to save or spend as you wish. This can be done by creating a list of all your monthly expenses, including fixed costs (like rent or mortgage payments) and variable expenses (like groceries or entertainment), and then subtracting that total from your monthly income.

Saving involves setting aside a portion of your income each month for future expenses or emergencies. This can be done by creating a separate savings account, setting up automatic transfers from your checking account, or finding other ways to consistently save a portion of your income.

There are several benefits to budgeting and saving, including reducing stress and anxiety around money, helping you reach your financial goals, and building a safety net for emergencies. However, it can be challenging to stick to a budget and save consistently, especially for beginners. To make it easier, consider the following tips:

Start with a realistic budget:

Start with a realistic budget: It’s important to create a budget that is realistic and feasible for you to stick to. Don’t set yourself up for failure by trying to cut back on expenses too much at once. Instead, start with small changes and gradually adjust your budget over time.

Track your spending:

Track your spending: Keeping track of your spending can help you see where your money is going and make changes to your budget as needed. You can use a budgeting app, spreadsheet, or pen and paper to do this.

Automate your savings:

Automate your savings: Setting up automatic transfers from your checking account to your savings account can help you save consistently without having to think about it.

Avoid impulse purchases:

Avoid impulse purchases: Impulse purchases can quickly add up and blow your budget. To avoid this, make a list of what you need before shopping and stick to it.

Be flexible:

Be flexible: Life is unpredictable and things may come up that require you to adjust your budget. Be prepared to make changes as needed and don’t be too hard on yourself if you slip up.

Reward yourself:

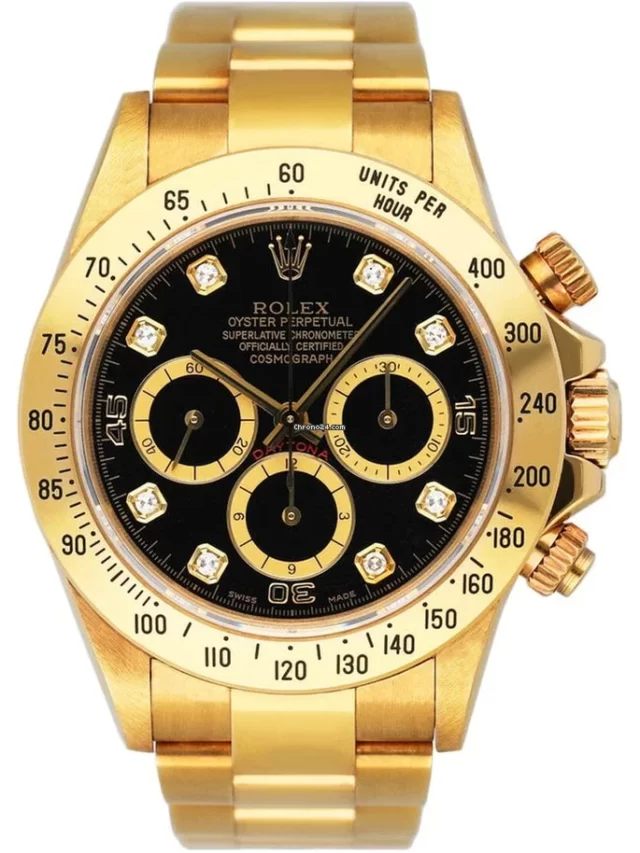

Reward yourself: Finally, it’s important to reward yourself for your hard work. Set up a system where you can treat yourself for sticking to your budget and reaching your savings goals.

Budgeting and saving may take some time to get used to, but the benefits are well worth the effort. By consistently following these tips and staying committed to your financial goals, you can take control of your money and reach a better financial future.